What do clients want even more than high investment returns? It’s the ability to answer their financial questions and get quick replies from you! The preferred means of communication for our clients is through text messages. Balancing a hectic schedule along with timely texting to clients can be a hard task. This guide will analyze how Texting For Financial Services can be used by financial professionals to provide value to clients enhance client relationship management and not make them feel overwhelmed.

We will get into details of practical cases, templates, and tactics to use texting that will allow you to provide 24/7 support, send reminders about appointments, advertise offers, and establish lasting contact with clients based upon trust.

Therefore, continue reading to discover how to capitalize on the flexibility of SMS to stay connected to clients wherever and whenever. Let us begin to form those lasting client relationships!

When we think of text messaging, we often just think of chatting with friends and family. But SMS can also be a powerful tool for communicating with clients in the financial world. Texting For Financial Services opens up a valuable two-way dialogue between financial institutions and their customers.

So how does it work? With financial SMS, banks and advisors can send account updates, fraud alerts, appointment reminders, portfolio snapshots, and special offers right to clients’ smartphones.

The immediacy of SMS allows for time-sensitive notifications and rapid response times. And customers can easily opt-in to receive texts on key account activities.

But Texting For Financial Services isn’t just useful for the institutions themselves. It also provides great benefits to clients. Who wouldn’t want portfolio updates instantly on their phone versus waiting for snail mail? Or the convenience of rescheduling a consultation with a quick text? Financial SMS allows for more personalized, efficient communication.

With the right SMS platform, financial institutions can seamlessly integrate texting into their client outreach and operations. The result? Happier customers who feel more connected and informed. So whether you’re a banker, advisor, or credit union, SMS just makes sense. Let’s explore the possibilities of financial texting!

Research reveals 90% of consumers like to interact with a brand via text message. This section will discuss the major reasons why financial texting is beneficial to both organizations and customers. Read further to understand how Texting For Financial Services can help build relationships and address growing client demands.

Compared to email and phone calls, texting allows for more spontaneous, on-the-spot discussions. SMS chats tend to result in a higher level of trust and relationship clients build with advisors. Small things matter a lot when it comes to clients feeling appreciated.

SMS marketing provides an opportunity for forward-thinking financial institutions to get ahead of the pack. With the growing popularity of messaging apps, texting demonstrates the readiness of your organization to use the latest technology. Branding your SMS program with creative campaigns helps you stand out even more. Becoming an industry leader in financial texting can be a key differentiator.

SMS notification automation eliminates errors that come from old or overlooked methods of communication. Targeted messages regarding changes in accounts, dates of payment due, new policies etc. make clients aware and know what’s going on. The result? Greater accuracy and fewer errors.

The time-sensitive promotional messages with higher response rates can be sent to clients through target SMS campaigns initiated by banks and advisors. Texting is more effective for audience engagement.

We’ve discussed why Texting For Financial Services is so effective. But how, specifically, can your organization leverage it? This section focuses on case studies of how text messaging is used in practice by banks, credit unions and other financial firms.

We will discuss real-life scenarios that work, ranging from welcome messages to policy updates to promotional offers. For further inspiration, below are some ideas that you can enact as of now to improve customer engagement. When you free the power of SMS, anything can happen.

Make new clients feel special right away. A personalised SMS welcome message presents your business and contact information while laying the groundwork for continued messaging. It demonstrates that you value communication and connections.

A personalised welcome text is an excellent way to provide your name, direct phone number, and personal service offer. To get the relationship started right, send a warm and pleasant greeting.

Quickly notify customers of changes to account terms, interest rates, fees, etc via SMS. Timely policy updates keep everyone on the same page and demonstrate transparency.

Important policy changes often get buried in long email notices that go unread. SMS alerts highlight the key details clients need to know and drive engagement.

Send Special Promotions and Offers:

Limited-time SMS promos create excitement and urgency that get clients to your branch or event. Trackable texts allow you to test offer performance across customer segments too.

Craft tempting SMS offers for new accounts, referrals, and events. Call-to-action promo texts typically see much higher response rates than email.

Email investment updates often go ignored. Proactively texting portfolio snapshots, market news and research gives clients updates right in their pocket. Strengthen advisor relationships with value-added texts.

Text in real-time about major portfolio changes or tailored insights. Investment SMS updates demonstrate you have clients’ interests top of mind 24/7.

This section provides real-world SMS templates and Texting For Financial Services examples tailored for the industry. Well-crafted text message notifications allow you to engage clients across many scenarios – from payment reminders to credit score updates and more.

Read on for message templates and tips you can use to connect with customers in a friendly, helpful tone that strengthens relationships. Let’s explore how to make the most of financial texting!

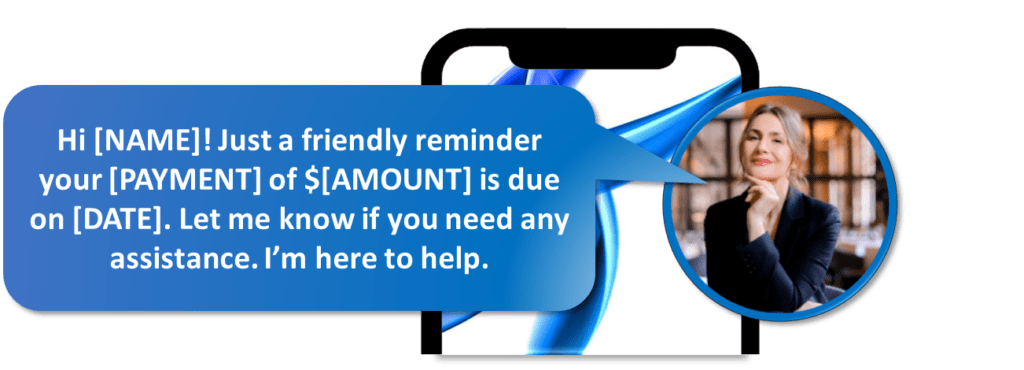

Gentle payment reminders via SMS are appreciated by clients, helping them avoid late fees or lapses. A friendly, courteous tone reassures customers you’re looking out for them. Be sure to include key details like their name, payment amount and due date. Offer to assist if they have any questions or concerns. Timely reminders show you have clients’ backs and can boost loyalty and trust.

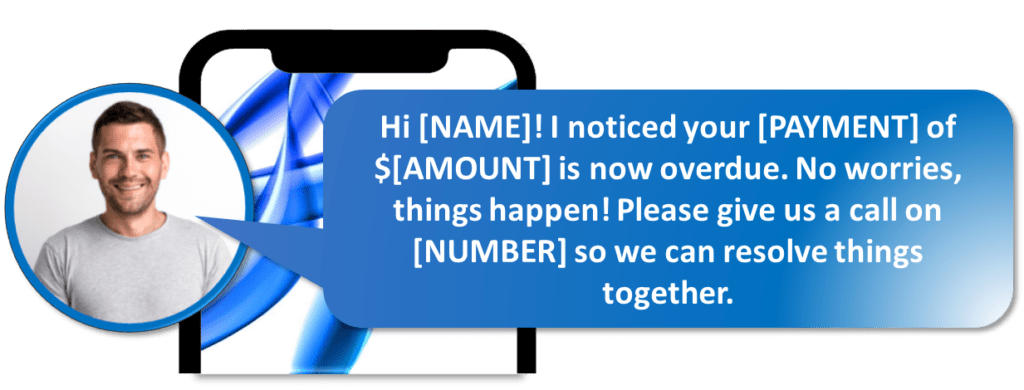

If an account falls behind, a polite SMS check-in demonstrates concern for the client’s situation, not just the payment. Use their name, specify the overdue amount, and offer to help get things resolved. Handled well, an overdue text keeps things positive while preventing further issues.

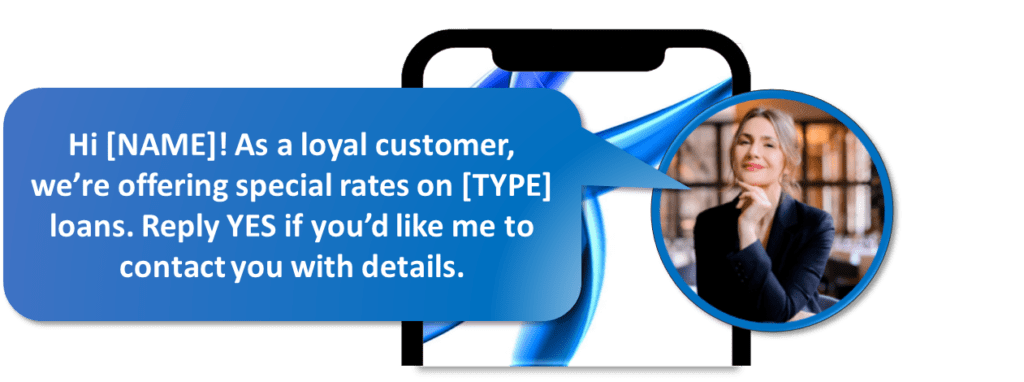

Targeted loan offers via SMS present timely incentives to qualified clients when they are most receptive. Personalize the message with their name and loan type. Give a clear call-to-action to have you contact them with details. Well-crafted offers prompt interest and applications.

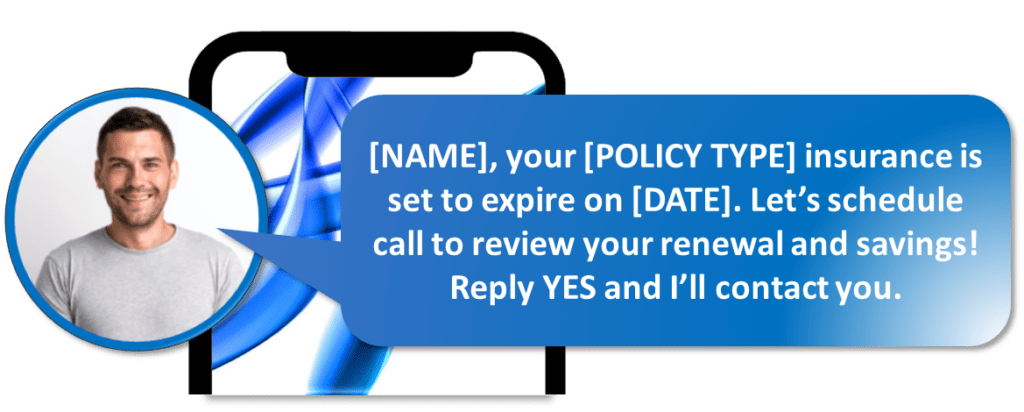

Insurance Renewal

SMS renewal reminders ensure clients don’t miss renewing policies on time. Include key details – their name, policy type and expiration date. Offer to discuss options to optimize coverage and savings. Proactive renewals keep you top of mind and policies active.

Post-service SMS surveys allow you to quickly gather candid feedback to identify areas for improvement. Keep it short with a 2-minute mobile-friendly survey. Clients feel valued knowing their feedback is important for enhancing your services.

Stay proactive by texting clients personalized insights on portfolio changes, market news and research. Share specifics like performance, holdings and timely articles. Outreach shows you have their investment goals top of mind 24/7.

Ongoing credit score updates via SMS keep clients informed, demonstrating you care about their financial health. Include their score change and helpful tips to boost it over time. Score monitoring texts show you’re invested in their success.

It is an important factor to have good customer relationships for success in financial services. Building rapport with customers takes a lot of time and effort, but its reward is loyalty, word-of-mouth advertising, and business growth.

Finally, we look at some critical ways in which the focus on client relations leads to a return on investment for finance professionals.

It is only when clients feel valued and have trust in their financial adviser that they are likely to stay with them for years. Those clients who remain faithful to their advisor or firm for a long time often have larger values. They also frequently seek help from their advisor on other services such as estate planning, and filing taxes, among others.

Retention value is not limited to assets under management. Loyal customers are also more open to suggestions and less likely to question or bargain for fees. They are also less prone to panicking in the face of short-term volatility.

Satisfied clients are ripe for cross-selling additional products and services. When a financial service provider has earned a client’s trust, it’s much easier to expand the relationship.

Wallet share refers to the percentage of a client’s investable assets managed by the advisor. Strong rapport makes it more likely clients will consolidate assets with their primary advisor. It also enables advisors to win new business like company retirement plans or wealth transfers for the children of clients.

This type of on-demand assistance is exactly what members prefer, but it is not typically provided in financial services. This kind of near-instant pleasure can help you stand out from the competition, increase word-of-mouth marketing, and encourage buyers to stick with your brand.

Happy clients are powerful sources of referrals for new business. When an advisor has really wowed a client with their service quality and care for the client’s needs, that client is eager to recommend the advisor to friends, family members and colleagues.

Referred prospects come with the built-in credibility of a trusted source vouching for the advisor. Research shows that referred leads convert at much higher rates compared to other lead sources.

Cultivating strong client relationships maximizes the likelihood of referrals. Advisors who consistently deliver personalized service and demonstrate how much they value the relationship will gain advocates who proactively send new business their way.

When clients implicitly trust their financial advisor, they are more receptive to guidance and recommendations. A satisfying relationship with responsive communication breeds confidence in the advisor’s expertise and judgment.

As a result, clients are more willing to act on investment recommendations like allocating a larger portion of assets to equities or opening a certain type of account. The advisor’s ability to influence financial decisions is much greater with established client relationships.

Strong relationships also make clients more patient and avoid knee-jerk reactions. During periods of market volatility, clients who view their advisor as a trusted partner generally stay the course instead of panicking.

Loyal clients are less fee-sensitive and willing to pay for an advisor’s time and services. As the relationship matures, some advisors raise their fee structure modestly over time.

Long-tenured clients also allow advisors to maximize efficiency. The advisor doesn’t need to spend extra time explaining terminology or their processes. Deep familiarity with the client’s situation makes preparing for meetings faster.

Higher revenue per client combined with increased efficiency produces stronger profit margins over time. Scale also comes into play – as books of business grow, fixed costs are spread across more assets.

In today’s digital age, the ability to effectively communicate with clients via texting is crucial for finance professionals. Texting For Financial Services SMS Software opens up new possibilities for advisors to conveniently provide 24/7 support, send timely reminders and updates, run targeted campaigns, and strengthen relationships overall.

However, juggling the demands of a busy practice while managing client texts can be a challenge without the right tools. That’s where LimeCall’s SMS software for financial advisors comes in.

LimeCall provides a comprehensive solution aimed at serving the requirements of financial professionals. It allows for conversational intelligence at scale. Built-in automation guarantees that you will never fail to respond to an important message.

LimeCall enables one to leverage the power of SMS marketing and messaging in order to increase engagement with clients. And their committed support staff is experienced in the finance sector and will make you successful.

So let’s get rolling and take your client communication up a notch! Get your free trial now and enjoy LimeCall SMS for financial services. The future of financial texting is positive, and it’s necessary to take advantage of the opportunity.

20, February 29, 2024, Vincent Hawley

Top rated callback automation platform that connects your website visitors to your team within 20 seconds through phone callback and whatsapp driving upto 40% more conversions.

Learn more